Delta Air Lines Airbus A330, with a KLM Boeing 747-400 in the background, in Amsterdam – Photo: David Parker Brown

At the start of last year, we looked at the results of the 2013 deliveries between Airbus and Boeing. With all the interest in that article, I couldn’t leave it alone for 2014, right? So let’s take a look at how the two big airliner companies did, in what is really the biggest aviation competition around?

2014 was a big year for both Boeing and Airbus. Last year we saw the first delivery of the A350XWB for Airbus, while Boeing also had delivery of the first 787-9 to Air New Zealand (followed closely by ANA).

On the narrowbody front, the A320NEO had its first flight (don’t those engines look like someone strapped giant engines onto the wing and went ’œit will work, trust me’) and the 737 MAX makes it one step closer to rolling out of the Renton factory. There were plenty of orders made to both airliners, but what we really want to know is, who produced and sold the most aircraft?

A Singapore Airlines Airbus A380 and Lufthansa Boeing 747-400 – Photo: David Parker Brown

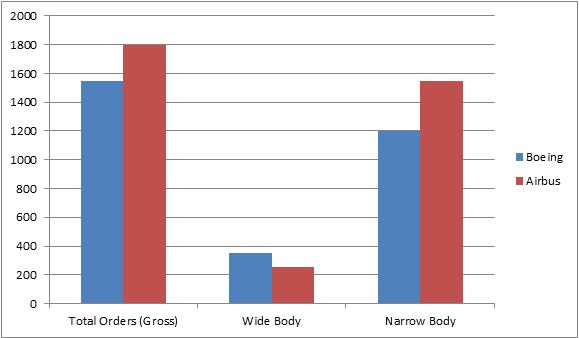

Orders:

2014’s major air shows were held in Singapore and in the UK at Farnborough. Airbus brought the A350 to Singapore for one of its first appearances and, of course, so many of us remember the amazing flight display that the Boeing 787-9 did on the first day of Farnborough.

We are going to compare gross orders (since that’s what we used last year) between both wide- and narrow-body aircraft. On the Airbus side, wide-body covers the A380, A350XWB, and A330. For Boeing it would be the 777, 747-8, and the 787. Narrow-body for Airbus would be the A320 family of aircraft (covering both CEO & NEO options) while Boeing would include the whole range of 737 Aircraft (Next Gen & MAX).

Airbus’ wide-body sales had a good year, with a combined 251 aircraft across the A380, A330, and A350. Boeing’s total wide-body sales accounted for 354 aircraft. This is a high number of aircraft, with the total buoyed by the release of the 777X in late 2013.

However, on the narrow-body, stakes were dominated by Airbus, with 1,545 aircraft ordered and Boeing only able to sell just under 1,200 of their 737s.

ORDERS VICTOR: Airbus

Ryanair ordering the specially-designed 737-MAX200 was surprising to the aviation community – Image: Boeing

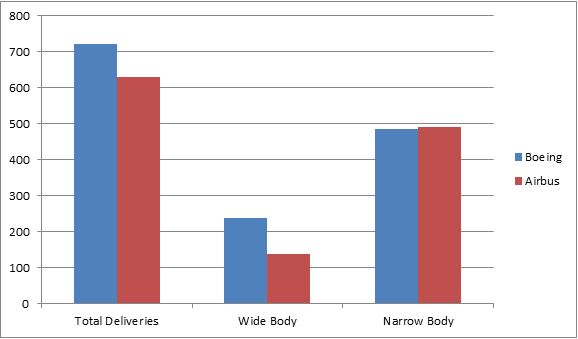

Deliveries:

Looking at Airbus, they delivered just one A350, 30 A380s, and 108 A330s, for a total of 139 wide-body aircraft. The A330 is surely the Airbus cash cow at the moment in the twin-aisle market.

Boeing delivered six 767s (yes, these still run off the line, in either a freighter or passenger variant), 19 of their 747-8s, and 99 777s. By far the biggest shock was how many 787s they were able to deliver: 114 in 2014.

Boeing’s overall total for wide-bodies made them the leader with a total of 238 aircraft, just under 100 more than Airbus.

The narrow-body market is where the largest number of orders come from, and Boeing sure has received many of those orders over the years with the 737 family of aircraft.

Since the first 737 was delivered in 1968, there have been over 8,000 others that have followed suit.

Boeing delivered a total of 485 this year, just narrowly missing out to Airbus who delivered a total of 491 from the A320 family. The backlog of the single-aisle market alone is almost at 10,000 aircraft; we’ll see these planes being built for quite some time.

DELIVERY VICTOR: Boeing

The 5,000th Boeing 737 Next Gen rolls out of the Renton Factory, destined for the US Navy – Photo: Boeing

2014 was a toss up again, with Boeing delivering more aircraft (due to a 787 production ramp up) while orders seemed to be far in favor of the European maker (especially for US-based airlines, with both American and Delta signing for extra aircraft from Airbus).

It is tough to tell what is going to happen in 2015, how either manufacturer can spur on future sales. But really with so many orders and deliveries in 2014, I think not only are Airbus and Boeing both victors, but also airlines and passengers.

Ironic photo – American airline flying a Euro plane, a Euro airline flying and American plane.

Heh — didn’t even notice that, but you are right.

David, AirlineReporter

Grass is always greener on the other side 🙂

Though the number of orders have been higher for Airbus, I believe Boeing would have made more profit due to the pricing model.

And btw for 2015, if the gas prices keeps falling down like it’s happening now, airlines may cut back on orders and stick with the current less fuel efficient aircrafts.

Hi Malcolm,

I think Boeing is also the orders victor, not in terms of aircraft ordered but in terms of the value of the orders. Boeing beat Airbus in wide-body aircraft sales which, as I understand, have a bigger contribution margin compared with narrow-body aircraft. Boeing’s revenue and profit in 2014 (more important indicators) should be higher than Airbus’.

Juan

Im doing a short presentation about Boeing for my class. What exactly is the difference between order and deliver, why are there different charts for that? When airlines order, of course planes are delivered right? Why do the numbers vary from delivered and ordered?

Thank you. Sorry if this is a stupid question, I just wanna understand. Thank you.

Zena,Good afternoon! How’s the presentation? Could you share the information? Any response from you will be a sign that you hear me.

Best Regards, Igor

@Zena Airlines might cancel orders if the order is late or if they changed their mind. For instance Quatar orders 67 787s in 2013 Boeing says they will deliver in 2015. Quatar switches to a350.