This story was written by Chris Sloan, who operates Airchive.com and is the creator/producer of the TV show Airport 24/7: Miami seen on the Travel Channel. This is a two part story. Read PART 1 here.

In spite of lining up the required financing and support from the governments of Canada, its home Province of Quebec, and the UK, Bombardier put the CSeries program on hold on January 31, 2006 after failing to secure enough orders to move ahead. Bombardier’s attention shifted to the CRJ1000. Just a year later on January 31, 2007, Bombardier restarted work on the CSeries.

BONUS: Taking an ERJ to Mexico on Continental, when the airline still existed

The aforementioned specifications and dimensions were locked in and the real development and marketing began. Late that year, Bombardier announced that an entirely new engine ’“ the Pratt and Whitney PurePower Geared Turbofan would be the exclusive power plant for the plane.

On February 22, 2008 the CSeries was officially made available for marketing to airline customers. Even amidst a deteriorating economic backdrop but perhaps spurred on by the sharply spiking fuel prices, Bombardier announced the official launch of the CSeries on July 13, 2007 at the Farnborough Air Show.

The key details announced were that launch customer, Lufthansa, had ordered 60 aircraft (including 30 options) for its Swiss European subsidiary. Bombardier also announced that final assembly would be an new line alongside the CRJ700/900/1000 line at Montreal’s Mirabel Airport. Additional major components, in particular the composite based wings and certain fuselage sections, would be built at the Bombardier factory in Belfast, Northern Ireland. The forward and some fuselage sections, as well as the cockpit, were supplied by Bombardier’s St-Laurent facility.

The CSeries program has several major suppliers including Shenyang Aircraft of China who contributes the rear barrel, Italian 787 contractor Alenia supplies the horizontal and vertical stabilizers, Zodiac provides the seating, bins, and cabin furnishings; and Rockwell Collins supplies the avionics suite (more on this later). Like the 787, these vendors reportedly have some equity and risk-sharing stakes in the program.

In a major March 2009 announcement, the aircraft were officially rebranded the CSeries CS100 and CSeries CS300. The C110 name always seemed like it could be confused with the military freighter. The CS100 title echoes the baseline-seating configuration of 100 seats, but there’s no clear reason as to the significance of the CS300 branding or why CS200 was skipped over’¦for now. At the same time, airline-leasing company Lease Corporation International unusually became the launch customer of the larger CS300, ordering 17 of these in addition to 3 of the smaller CS100s.

Over the next 5 years, orders from 13 customers totaling 66 for the CS100 and 114 for the larger CS300 accrued for a total of 180 orders, hardly a ’œbarn burning number’ but enough to move forward with the program. Bombardier doesn’t confirm these numbers however saying they have orders and commitments for 382 CSeries. Given the harsh worldwide economic conditions of the last few years and this being unchartered territory for Bombardier, the number is respectable but needs to grow quickly to come anywhere near Bombardier’s targets.

Even though sales haven’t set the world on fire, Bombardier conceives the CSeries not as a niche aircraft. Bridging the RJ and 737/A320 gap in the 100-149 passenger range, they forecast the market to be over 19,000 aircraft and $250 billion in revenue over the next 20 years. Further, they very optimistically expect to capture up to half of this market with the CSeries, identifying the aircraft as the future of the company.

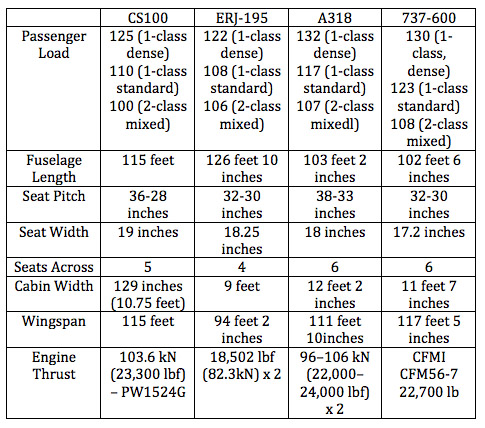

The proof will be in the pudding, and the pudding is definitely a new recipe in the class with major technical advancements. In today’s high fuel price environment and razor-thin profit margins, fuel burn and operating costs are the leading consideration. Bombardier claims a 15% cash operating costs advantage and 20% fuel burn advantage over the E-Jets and other competition. Further, they claim a 25% direct maintenance cost savings. Environmental benefits run a close second. Bombardier promises the CSeries produces 50% fewer NOx emissions relative to its competition and has a 4 times quieter noise footprint.

Bombardier achieves these gains via 70% of the airframe being constructed of advanced materials such as composites and carbon-fiber (though not to the extent of the 787 or A350XWB) and the next generation engines. These technologies allow for greatly reduced weight and maintenance. The manufacturer claims the CSeries aircraft will be up to 12,000 lbs lighter than other aircraft in the same seat category. Importantly, the CSeries doesn’t rely on the extensive electrical architecture as the 787 and uses traditional Nickel-Cadmium batteries as opposed to the problem plagued lithium-ion batteries that have bedeviled the Dreamliner.

The spacious and very visible flight deck is also advanced, and in fact features Bombardier’s first use of sidestick three-axis full fly-by-wire controls and a new auto-throttle system. The Rockwell Collins Avionics Suite features the now compulsory large LCD displays, dual FMS (Flight Management System) with optimized control and display functions, dual CCD (Cursor Control System), datalink, sensed electronic checklist, and Cat llla autoland abilities. Optional features include single or dual EFB (Electronic Flight Bag), Cat lllb autoland capability and HUD (Single/ Dual Head Up Display) to optimize flight preparation, operation and mission completion. Key to efficiency in this category is the new RNP0.1 technology that allows the CSeries precise fly routes, continuous descent, optimized missions and approaches, and reduced emissions and noises. In another spark of ergonomic innovation, the radio panel is integrated into the glareshield.

Like the 787 and upcoming Airbus A350XWB, the CSeries boasts cabin enhancement features most of which are entirely new to its class: larger windows, dynamic LED ’œmood-lighting’, and upsized overhead binds offering 20-25% more volume than its narrow-body competition. With most of the fuselage not being of composite construction and most routes being short-to-mid haul, lowered altitude cabin pressurization ala the Boeing 787 Dreamliner wasn’t included in the feature list. At 41,000 feet, the CSeries’ cabin is pressurized at 8,000 feet.

The rollout, billed as a Program Update, was held at Bombardier’s Montreal Mirabel manufacturing facility where all the company’s commercial airline production operations are now concentrated. The packed house of 200 journalists, analysts, customers, and VIPs were joined by an event simultaneously taking place at Bombardier’s wing manufacturing facility in Belfast, Northern Ireland. Video packages from major suppliers around the world were also part of the mix.

Mike Arcamone, President Bombardier Commercial Aircraft presided over much of these announcements in a clearly excited, but well-paced, emcee fashion. With dramatic lighting and slide presentations in French and English, this being Quebec after all, the program began with a number of product updates to be shared.

In the first of the morning’s big announcements, Bombardier confirmed the rumored launch (first reported in November, 2012 by Flight Global) of its new 160 seat extra capacity option. This option, available in all CSeries CS300 models will be achieved by reducing seat pitch to 28’ using Zodiac slim-line seats and adding an extra set of emergency exits over the doors. This option ups the original maximum capacity of 135-45 seats. Air Baltic of Latvia will be the first of the three launch customers of this option, but will operate their aircraft with 148 seats. With the extra capacity option, Bombardier claims an 8% increase in seat economics over the baseline CS300.

The program timeline indicates all the aforementioned dates remain on track, with the CS100 still expected to take its first flight by June 30, 2013 and the flight-testing program to begin shortly thereafter. EIS will be mid-2014. The CS300 first flight and EIS is still in the 2014/2015 timeframe respectively.

The windows are quite larger on the new Cseries, providing more natural light and shoulder room. Photo by David Parker Brown / AirlineReporter.com.

On the manufacturing side, Bombardier confirmed that after the first few test and production aircraft are built in a temporary line at Mirablel, the new pulsing, moving final assembly line opening in 2014 would be capable of producing up to 100 CSeries per year. They didn’t disclose the date they would reach this level however. Bombardier has had lots of experience with out-sourcing and with the simpler structure, this does seem like a realistic goal.

After all the briefings concluded, the crescendo arrived. With the theatrics of a Las Vegas show, the projection screen lifted to reveal FTV-1, the first CSeries. Bathed in a dramatic dark blue light, de-emphasizing its unpainted ’œgreen’ state and flanked by proud Bombardier employees, the aircraft received a standing ovation for its first performance. Some may argue the program’s long-term prospects but even in this un-finished state (with missing fairings), everyone agreed the aggressively sculpted aircraft looked beautiful, and was practically begging to fly.

Of course, it was a bit of a surprise that Bombardier didn’t paint their first aircraft in a flashy livery as others have done, and it is unknown whether to what extent it will be painted for the first flight. To their credit of not hiding anything, Bombardier did raise the house lights so the audience could see the detail of the still impressive unfinished aircraft. Almost instantly following the event, workers surrounded the aircraft and resumed their round the clock 3-shift schedule to get the aircraft airworthy.

Everyone expected the CSeries to be rolled out but what they didn’t expect was that Bombardier had a big surprise up their sleeve! Minutes after the unveiling of the CS100, they dropped another curtain to reveal 3 more flight test aircraft in some cases advanced forms of build: FTV-1, 2, and 3. This unexpected moment drew another round of cacophonous applause. Bombardier will have 7 FTV’s ’œFlight Test Vehicles’ (a ’œNASA’ way of saying ’œaircraft’) in their flight testing program: 5 CS100s and 2 CS300s. FTV-1 will be used more for aerodynamic flight dynamics tests while FTV-2 will be heavily focused on avionics. CS100 FTV-5 will be the first with the passenger cabin.

The ultra-efficient, high bypass Pratt and Whitney PurePower 1500 Geared Turbofan generates up to 23,000 pounds of thrust while reducing fuel burn 20-25% and decreasing the noise footprint by up to 4X. Photo by Chris Sloan / AirlineReporter.com.

Virtually all recent commercial aircraft programs timelines have slipped and the CSeries is no exception. Though certainly its much less complicated supply and manufacturing chain has thus far led to much fewer and shorter delays then the admittedly much larger and more technologically demanding Airbus A380 and Boeing 787. The first flight of the C100 was originally confirmed for the second half of 2012 and then December 2012. Deliveries were confirmed to begin by the end of 2013. With roll out on March 7, 2013 the first flight date has obviously slipped but is pegged to be no later than June 30th. If the 12-month flight test and certification program remains on schedule, deliveries will commence in mid-to-late 2014. The C300s timeline is about a year later with first flight in 2014 and deliveries commencing in 2015.

A big question is how competitors A, B, & E will respond once the aircraft enters service. In response to the CSeries, Embraer considered the idea of a fresh design, but as Bombardier did with its CRJ700/900/1000 series instead chose the conservative route. They announced they would counter the CSeries with updated 2nd generation versions of their E-Jets, further amortizing the costs of the platform.

The new E-Jets, announced in 2011, would feature a slightly stretched fuselage, a new composite based wing, and taller landing gear to accommodate a much more fuel-efficient Pratt & Whitney geared turbofan engine, similar to that of the C-Series. According to ’œFlight Global’, Embraer has said the next generation E-Jets tentatively titled the 198, should appear between 2016-2018 but these haven’t been confirmed.

With Boeing and Airbus both choosing to go with their next generation 737 Max and A320 Neo versions of their cash cow aircraft instead of fresh designs, Bombardier looks to have the technological edge in the lower capacity portion of this market at least until the middle of the 2020s. Claiming 20-25% increases in fuel efficiency without resorting to more vanguard technologies that they claim is more apparent in the long haul and could threaten their current cash cows, Boeing and Airbus bowed to their shareholders and airlines who wanted a quicker solution and also chose the conservative route.

The ultra-modern CSeries flight deck features the Rockwell Collins Pro Line Fusion avionics suite with optional Electronic Flight Bags (EFB’s) and Heads-up displays (HUD’s). Image from Bombardier.

Not to be overlooked, the 2000s have not been kind to smooth manufacturing, testing, deliveries, on-time entries into service, and in-flight reliability of any of these game-changing aircraft, to wit the Airbus A380 and Boeing 787 Dreamliner. How smoothly the manufacturing ramp up is (Bombardier projects first year production will be 20-30 aircraft, and up to 120 a year by 3 1/2 years) how quickly the CSeries begins its deliveries (mid 2014), and perhaps most importantly how reliable it is once it enters service (Bombardier is promising s 99% dispatch reliability at EIS) will determine whether this aircraft is not only a game changer for Bombardier but for the entire industry.

Bombardier has changed the game before, however, and the industry knows better then to bet against them. Responding to a particularly pointed question from ’œThe Wall Street Journal’s’ Jon Ostrower about Bombardier taking on the Airbus and Boeing duopoly, BCA President Mike Arcamone in a not thinly veiled reference to the upcoming Max and Neo, said ’œThis is a real airplane not a paper airplane. This is not a re-engined aircraft but a new aircraft with a proven mix of new and proven technology. We will be there and we will win.”

GET MORE BOMBARDIER CSERIES STUFF:

|

This story written by…Chris Sloan, Correspondent.

Chris has been an airline enthusiast, or #AvGeek, since he was 5 years old. Over the years, he has amassed an extensive collection of aviation memorabilia and photos that he shares on his site, Airchive.com. He is the President and Founder of the TV production and promotion company, 2CMedia.com and Executive Producer and Creator of ’œAirport 24/7’ Travel Channel series. |